How to get your SF home ready for market in 2026!

Before-Listing Preparation Checklist

1. If possible, plan to move out.

Most homes here, whether it’s a mid-century in the Parkside or a Victorian in Lower Haight, will come to market vacant and staged. An empty home is easier to repair, clean, stage, and show. Living in the home during the sale is possible, but it almost always limits how well it presents.

2. Schedule inspections early.

Older SF homes commonly surface issues like:

- Dry rot in exterior trim

- Termite damage

- Roof at the end of its useful life

- Outdated wiring

- Foundation movement

Finding these upfront lets you fix what makes sense and disclose the rest clearly. Late surprises cost leverage.

3. Handle repairs before anything cosmetic.

Start with items that can scare buyers or impact financing:

-

Active leaks

-

Electrical issues

-

Non-functioning heaters

-

Loose railings or steps

Then address visible fixes buyers notice right away:

-

Doors that stick

-

Cracked drywall

-

Broken windowpanes

These small items signal how the home has been cared for.

4. Declutter aggressively.

This means everything:

-

Closets

-

Cabinets

-

Garage

-

Storage rooms

In SF, space is the product. If it feels tight, buyers assume the home is small.

5. Paint if needed.

Light, neutral colors show best. Trim and doors matter as much as walls. In foggy Sunset and Parkside blocks, even modest exterior touch-ups help.

6. Deep clean.

Windows matter because of fog and low light. Kitchens and bathrooms need to be spotless. Odors need to be removed, not covered.

7. Finish with curb appeal.

Buyers form opinions before they reach the front door. Landscaping and removing grime and buildup from the exterior add a sense of care and make the home feel well maintained.

8. Staging comes last, once everything else is done.

Staging consistently works. In San Francisco, staged homes typically sell for several percent more than unstaged homes and attract stronger early interest. It’s not absolutely necessary, but I strongly recommend it when the goal is a clean launch and maximum buyer response. An as-is sale may call for a different approach.

Decluttering, Repairs, and Curb Appeal That Matter in SF

Buyers notice space first. Flow comes right after.

Decluttering affects both.

-

Oversized furniture makes rooms feel smaller

-

Crowded entries feel chaotic

-

Fewer pieces usually show better than rearranging

In older Victorians and Edwardians, editing furniture often matters more than layout changes.

Closets matter.

Buyers open them. Half-empty and organized reads as usable storage. Packed closets raise questions.

Condition beats style.

Buyers will live with an older kitchen if it is:

-

Clean

-

Bright

-

Odor-free

They will not ignore:

-

Water stains

-

Musty smells

-

Windows that do not open

These suggest larger problems in SF housing stock.

Curb appeal depends on the neighborhood.

-

In Westwood Park and Ingleside Terrace, buyers notice yards and exterior upkeep

-

In row-house neighborhoods like the Sunset, they focus on the entrance, door, lighting, and facade

Peeling paint and broken fixtures create hesitation before buyers walk in.

Some cosmetic datedness can pass if everything else feels right. Dirt, damage, and odors do not.

Staging Tips That Sell Homes in This Market

Staging in San Francisco is standard. It is about clarity, not decoration.

Lighting comes first.

-

Many homes lack overhead lighting

-

Lamps are necessary

-

Bulb color should be consistent

Dark rooms feel smaller and shorten showings.

Furniture scale matters.

-

Small rooms need smaller furniture

-

King beds and oversized sectionals usually work against you

Flow matters more than symmetry.

-

Older layouts can be awkward

-

Staging should show how rooms connect and function

Neutral works best, but not empty.

-

Light palettes feel current

-

A few restrained accents help rooms feel lived-in

Condos and houses stage differently.

-

Condos lean cleaner and more modern to emphasize openness

-

Single-family homes often feel warmer, especially in Sunnyside and Excelsior neighborhoods where buyers plan to stay

Outdoor space should be staged if it exists.

Even a small deck or balcony matters in SF.

Budget-Friendly Updates With Real ROI

You do not need a major remodel to improve buyer perception.

Paint is usually the best spend.

-

Interior walls, trim, and doors

-

Spot exterior work on the front of the house

Lighting upgrades pay off quickly.

-

Updated fixtures

-

Brighter bulbs

-

Consistent color temperature

Floors matter.

-

Refinish hardwoods if they exist, common in mid-century Sunset and Parkside homes

-

Replace worn carpet or damaged flooring

Targeted kitchen and bath updates help.

-

Cabinet paint and new hardware

-

Updated faucets and light fixtures

-

Clean grout and recaulked tubs

Basic maintenance counts.

-

Clean windows

-

Serviced systems

-

Tidy electrical panels

Avoid over-improving. Updates should match the neighborhood and price point.

Common Seller Mistakes That Cost Money

Selling fully occupied.

Homes are harder to show, harder to keep clean, and harder for buyers to imagine as theirs.

Over-personalizing.

Bold colors and themed decor narrow the buyer pool.

Hiding clutter instead of removing it.

Buyers open everything.

Underestimating cleaning and odors.

Pet smells and stale air shorten showings fast.

Ignoring the exterior.

Buyers form opinions before they walk in.

Poor lighting.

Dark homes feel smaller and less welcoming.

Trying to DIY everything.

Rushed paint, poor staging, and bad photos often cost more than hiring professionals.

Misjudging buyer expectations.

SF buyers compare homes closely and quickly. Falling short leads to longer market time and price reductions.

Final Thoughts for SF Sellers

Preparation matters here. Buyers move fast and compare everything.

Two similar homes can sell very differently based on prep alone. I see it often here in San Francisco.

Every home is different. A TIC in Hayes Valley does not prep the same way as a detached home in Sunnyside or West Portal. The approach stays consistent. The execution changes.

Local Love: Why Hayes Valley and Lower Haight Keep Drawing San Francisco Homebuyers

San Francisco’s District 6B neighborhoods Hayes Valley and Lower Haight have a special hold on homebuyers’ hearts. These two enclaves each offer a distinctive lifestyle and character, yet both share an undeniable appeal rooted in community spirit and vibrant local culture. In this narrative tour, we explore what makes Hayes Valley and Lower Haight enduring favorites, from morning coffee runs and boutique shopping to dog-friendly parks, public art, and lively block parties. Whether you’re considering buying in these areas or strategizing a home sale, read on to discover the upscale and relatable charms that keep drawing people in.

Hayes Valley: Upscale Charm Meets Creative Soul

Imagine starting your day in Hayes Valley with a stroll down a tree-lined street, aromatic coffee in hand from a hip café. This neighborhood is renowned for its unique blend of charming boutiques, trendy cafes, and dynamic art galleries. In the mornings, locals perch at sidewalk tables, sipping lattes and chatting with neighbors. Along Hayes Street, independent designer shops and chic home-goods stores invite window shopping. It’s not uncommon to see a fashionista browsing at a stylish boutique next door to someone walking their dog to Patricia’s Green, the beloved little park at the neighborhood’s heart.

Patricia’s Green is more than a park, it’s a community living room. By day you’ll find dog owners mingling as their pups wag hello, and parents watching children play. At any given time, you might stumble upon an intriguing public art installation in the center of the Green. (Hayes Valley has a tradition of rotating art here – from fanciful sculptures to Burning Man pieces – making the park a mini outdoor gallery.) On weekends, this spot buzzes with activity: think pop-up craft fairs, outdoor fitness classes, or even free movie nights at the adjacent PROXY plaza. The neighborhood’s community calendar is rich with events like the annual Hayes Valley Carnival and Wine Walk, which fill the streets with music, food, and laughter. It’s the kind of place where on a sunny afternoon you might catch a live jazz trio performing outside SFJAZZ Center or stumble upon a designer trunk show hosted by local merchants.

Despite its trendy reputation, Hayes Valley maintains a welcoming, creative soul. Locals pride themselves on the arts and cultural scene intertwined with daily life here. The neighborhood sits just a stone’s throw from San Francisco’s major performing arts venues – the symphony, opera, and ballet are all nearby giving Hayes Valley a cosmopolitan flair. Yet on these same blocks you’ll also find community gardens and painted murals that speak to a grassroots artistic vibe. It’s this mix of high-end and homey that residents adore. One minute you could be savoring a Michelin-starred meal at a chic restaurant, and the next you’re grabbing an ice cream from a street kiosk and joining neighbors on a bench at Patricia’s Green to people-watch. The pedestrian-friendly layout encourages strolling, and hidden gems abound down little alleys like Linden Street (home to cozy coffee spots and patisseries). In short, Hayes Valley manages to feel like a village within the city, a place with upscale amenities that still says “come as you are.”

Homes in Hayes Valley reflect this blend of modern style and historic charm. Many streets are lined with classic Victorian and Edwardian flats, their bay windows and ornate facades a reminder of the area’s 19th-century roots. These vintage buildings often contain updated condos or tenancy-in-common (TIC) units, offering the best of old and new – think high ceilings and period moldings paired with remodeled kitchens. In fact, four- to five-story Edwardian condominium buildings are the most common residential type here, seamlessly integrated into the neighborhood fabric. Tucked among them, you’ll also find the occasional Queen Anne Victorian house, lovingly preserved and painted in quintessential San Francisco colors.

At the same time, Hayes Valley has seen a wave of new development since the 1990s that adds contemporary living options. After the removal of the Central Freeway spur in the 1989 earthquake’s aftermath, the neighborhood underwent a renaissance, transforming into a pedestrian-friendly enclave filled with boutique shops, art galleries, and trendy restaurants. On formerly vacant lots, modern condo buildings have risen – sleek, architect-designed complexes with amenities like roof decks and secure lobbies. For example, around Octavia Boulevard (the boulevard that replaced the freeway) you’ll notice stylish mid-rise condos and eco-friendly apartments that attract professionals and families alike. These newer residences often feature floor-to-ceiling windows, open floor plans, and shared courtyards, adding a fresh elegance to Hayes Valley’s housing mix.

What’s consistent across Hayes Valley homes is the lifestyle value they offer. Many properties are just steps from the action – a few blocks from that favorite brunch spot or yoga studio – which is a huge draw for buyers. If you live here, everything truly is “right outside your doorstep,” from the trendiest stores to the local opera house. Residents enjoy an urban lifestyle without high-rises or hectic crowds; it’s a friendly, human-scaled scene. Buyers are drawn to the idea of morning walks to get croissants, afternoons browsing a gallery, and evenings meeting friends at the wine bar down the street. For sellers in Hayes Valley, this presents a golden opportunity: by highlighting the lifestyle perks that surround your home, you tap directly into what makes this area special. Is there a cozy cafe or bakery around the corner? A balcony with a view of the downtown skyline or the treetops of Patricia’s Green? Emphasize those in your listing or staging. Maybe set a bistro table on your front stoop with a coffee cup and croissant to evoke the morning routine, or display local art in your home to mirror the neighborhood’s artistic bent. Buyers here respond to that blend of style and community. In Hayes Valley, it’s not just the home they’re buying – it’s a membership into an eclectic, upscale-yet-warm community that celebrates art, food, and togetherness. Savvy sellers will showcase how their property lets the buyer step right into the Hayes Valley lifestyle.

Lower Haight: Gritty Energy and True Community

If Hayes Valley is a polished gem, Lower Haight is its more bohemian cousin – a neighborhood with an edge, a past, and a whole lot of heart. Life in the Lower Haight might start with a walk down Haight Street’s eclectic stretch, where colorful murals cover building walls and the smell of fresh coffee mingles with street art and music. This area is less famous than its Haight-Ashbury neighbor, but what it lacks in ’60s hippie nostalgia it makes up for in substance. Lower Haight greets you with vibrant street art, indie shops, dive bars, and local love at every turn. Here, tattoo parlors sit comfortably next to meditation centers, and funky vinyl record stores share the block with vintage clothing boutiques. The vibe is “grunge-chic meets post-punk boho,” as one local observer cleverly put it. In other words, Lower Haight wears its creative individuality proudly on its sleeve.

Strolling through the neighborhood, you’ll notice its human scale and unpretentious feel. Mornings are mellow – perhaps you’ll grab a pastry at the corner cafe (many swear by Kate’s Kitchen or a fair-trade coffee at Sightglass), and you might say hello to longtime shop owners opening up for the day. By afternoon, the sidewalks get livelier with residents running errands and friends meeting up for lunch at one of the many global eateries (this small area boasts everything from tasty tacos to Thai curry). The Lower Haight is a haven for independently owned stores and eateries, one of the “last havens of independently owned boutiques in SF,” as some enthuse. There’s a refreshing absence of big chains; instead, you find quirky record shops, comic book stores, bike repair shops, and tiny art galleries that double as community studios. This fosters a strong neighborhood identity – you get to know the characters who run and frequent these businesses, and they give the area its welcoming, slightly offbeat character.

Evenings in Lower Haight are when its legendary nightlife comes out to play. As dusk settles, Haight Street’s bars and lounges light up (figuratively – a few are literally quite dimly lit, in classic dive bar fashion!). Music drifts out of pub doorways. Two of San Francisco’s best beer bars, Toronado and Mad Dog in the Fog, face each other on Haight, forming what’s affectionately known as “Microbrew Alley”. Toronado’s craft beer selection draws aficionados citywide, while Mad Dog is the go-to for UK expats catching a soccer match at odd hours. If you prefer cocktails, spots like Maven offer inventive drinks in a stylish setting, and beloved dives like Molotov’s keep the old-school spirit alive (cheap drinks, punk rock on the jukebox, and maybe a dog lounging under a barstool). There’s truly something for everyone’s taste. Locals often do an informal “bar crawl” – starting with a pint and pinball at one bar, then shifting to another for live DJ music or a game of pool. Through it all, there’s a sense of camaraderie. Regulars, bartenders, and newcomers mingle freely. It’s not uncommon for friendly conversations to spark between strangers over the Warriors game on TV or the mural someone saw unveiled down the block. One of my personal favorite spots on the block is Woods Lowside, a cozy neighborhood taproom that always has an excellent lineup of local brews and small-batch creations on tap.

While Lower Haight’s gritty, graffiti-splashed style might seem edgy, the neighborhood’s soul is remarkably warm and tight-knit. This is a community where neighbors look out for each other. One resident described the strong bond among Lower Haight locals, noting how they rally together in times of need and take pride in their block. A dramatic example often told is of a nearby apartment fire a few years back, the local butcher from Haight Street reportedly rushed in to alert residents, and displaced neighbors were immediately offered refuge in nearby shops and bars until it was safe misadventureswithandi.com. Stories like this illustrate a real community spirit: in Lower Haight, merchants and residents alike show up for one another. The neighborhood has an active merchants and neighbors association that organizes quarterly Art Walks and block parties to celebrate this unity. During these events, Haight Street transforms into a festive fairground – sidewalks become pop-up galleries for local artists, musicians perform live sets on the corners, and everyone from families with strollers to older hippies to young tech workers comes out to mingle. The Lower Haight Art Walk, for instance, is a free community event that fills the street with local art, music, and open-house specials at shops. It’s a joyous showcase of exactly what makes this area special: creativity and neighborly connection thriving hand in hand.

Recreation and green space add to Lower Haight’s lifestyle allure as well. Tucked at the neighborhood’s southern edge is Duboce Park, one of the city’s most beloved dog-friendly parks. On any given day, you’ll find a happy pack of pups chasing balls in the off-leash dog play area while owners chat amiably (Duboce Park is known for its sociable scene among dog owners and families. Even if you don’t have a pet, it’s a lovely spot to relax on the grass and soak up the sun. Living in Lower Haight means having this little oasis just a short walk away – a big plus for anyone who values outdoor time. Additionally, Alamo Square with its iconic Painted Lady Victorians is only a few blocks north, and the Panhandle of Golden Gate Park is a short stroll west, so greenery is never far. The neighborhood is also a haven for cyclists: the famous “Wiggle” bike route (a flat zigzag through the city’s hills) runs right through Lower Haight, making it a convenient area for commuting by bike without breaking a sweat. Public transit is easy too – the N-Judah Muni light rail stops at Duboce, ready to whisk residents downtown or to the beach, one reason the area is described as “surprisingly central and accessible” by locals. In fact, Lower Haight’s location is a huge perk: it’s walkable to Hayes Valley, the Mission, Duboce Triangle, NoPa, and Alamo Square – all within 10-15 minutes – placing it literally in the middle of many vibrant districts. Homebuyers appreciate that centrality, as it offers the ability to explore multiple great neighborhoods easily while enjoying the Lower Haight’s unique vibe as a home base.

When it comes to homes in Lower Haight, the housing stock is as eclectic as the community. The neighborhood is primarily residential beyond the Haight Street commercial strip, with rows of classic San Francisco houses showcasing Victorian and Edwardian architecture. Strolling down side streets like Waller or Page, you’ll see colorful Victorian facades adorned with bay windows, decorative trim, and the occasional whimsical paint job. Many of these buildings date back to the late 1800s and early 1900s – they’re the kind of well-preserved charm that makes San Francisco famous. Inside, they’re often divided into flats (upper and lower units) or multi-unit apartments. It’s common for these to be owned as tenancy-in-common (TIC) shares or condominiums, since many large old homes were converted to multi-unit housing over the years. For buyers, that means opportunities to own a piece of a beautiful Victorian at a somewhat lower price than a whole house – a popular option for young professionals who love historic character. These TIC or condo flats often feature period details like crown moldings, vintage fireplace mantels, and hardwood floors that appeal to those craving authenticity. At the same time, savvy remodels have outfitted many with modern kitchens and updated systems, blending old soul with new comfort.

While historic homes dominate, there are a few modern touches sprinkled in Lower Haight’s residential scene. A handful of contemporary condo buildings or lofts have been built on infill lots, usually 3-4 story buildings that are designed to complement the streetscape. You might notice a newer glass-and-steel facade peeking between painted ladies – offering things like elevators and roof decks – for those who want a more turnkey modern home. However, larger development is relatively rare (Lower Haight wasn’t subject to the same redevelopment as Hayes Valley). This means the neighborhood’s architectural character stays intact, which is exactly what attracts many buyers. People who move here often want that sense of history – they fall in love with the quirky angles of a gabled roof, or the fact that their building has a name etched above the door from a century ago. It’s all part of the story.

The emotional and lifestyle value of living in Lower Haight is hard to quantify but easy to feel. There’s a deep sense of authenticity here. Residents often describe the neighborhood as “laid-back and welcoming”, with a diversity of people and a come-as-you-are mentality. You can be a tech worker, an artist, a young family, or a retiree – everyone finds their place in the mix. The individualism of the Lower Haight shines through not just in its street art and funky shops, but in the people who call it home. There’s a palpable pride among locals about keeping the neighborhood’s creative, slightly rebellious spirit alive. For many, living here means being part of a living canvas – you’re contributing to the ongoing story of a neighborhood that has reinvented itself many times (from working-class roots to punk haven to today’s diverse community) yet managed to stay true to a vibe of inclusivity and creativity. Every day can bring a small delight: discovering a new mural on your walk, chatting with the barista who remembers your order, or joining neighbors for an impromptu block party that someone posted about on a flyer. This sense of discovery and connection is what really draws homebuyers, beyond just the nice floorplans or square footage.

If you’re a seller in Lower Haight, your best strategy is to sell the story as much as the property. Buyers are already enamored with what they know of the neighborhood’s lifestyle, so show them how your home is a gateway to that. Have a Victorian flat with a bay window? Dress it up with a comfy window seat to evoke lazy Sunday mornings with a book, bathed in that classic SF light. Does your place have a bit of a funky edge – exposed brick, a colorful garden, or local art on the walls? Embrace it! Those touches resonate with the area’s character. You’ll want to mention proximity to things like Duboce Park (“a five-minute walk for dog lovers and picnic enthusiasts”) or the handy transit lines around the corner, or how your street hosts an annual block party. If there’s a popular café or bakery nearby, perhaps leave out some fresh pastries during an open house to subconsciously link the home with the delicious perks of the location. Highlight any community-oriented features of your property – for example, “ample front stoop space, perfect for chatting with neighbors,” or a shared backyard garden that has hosted barbeques. These are the lifestyle elements that turn a casual buyer into someone who can picture themselves living here. Essentially, you want to paint the picture that by purchasing your home, they aren’t just getting real estate – they’re joining a warm, vibrant community that will enrich their day-to-day life. That emotional pull is powerful. Lower Haight buyers are often as interested in being part of the scene as they are in the home itself, so make it easy for them to fall in love with both.

Embracing the District 6B Lifestyle

Hayes Valley and Lower Haight each offer a unique flavor of San Francisco life – one polished and fashionable, the other gritty and artsy – yet both exemplify the “local love” that transforms a neighborhood from just an address into a beloved home. In these communities, quality of life is measured in more than property values. It’s in the morning greetings at the cafe, the mural you watch an artist bring to life on your block, the impromptu dog playdate at the park, or the way the bakery owner asks how you’ve been. Homebuyers feel this warmth and energy, and that’s why they keep coming. These neighborhoods draw people in not just with what they have, but how they make you feel: connected, inspired, and part of something special.

For buyers, District 6B offers the promise of an enviable urban lifestyle – whether you’re into haute couture and ballet performances or rock shows and underground comics. For sellers, understanding this allure is key. It’s the lifestyle and community that ultimately sell the home. Present your Hayes Valley or Lower Haight property as not just four walls and a roof, but as a ticket to an experience – a daily rhythm of neighborhood joy that few other places can replicate. From the upscale cultural canvas of Hayes Valley to the raw creative tapestry of Lower Haight, the enduring appeal lies in their ability to feel like small-town communities amid a big city. That is the local love that keeps homebuyers enthralled year after year. Embrace it, and whether you’re moving in or moving on, you’ll understand why these storied streets hold a cherished place in San Francisco’s heart.

Sources: hayesvalleysf.org crawlsf.com secretsanfrancisco.com sanfranciscojeeptours.com homes.com sf.funcheap.com,

Tenancy in Common (TIC) in San Francisco: A Comprehensive Guide

What is a Tenancy in Common (TIC)?

A Tenancy in Common (TIC) is a form of joint property ownership. In a TIC, multiple people co-own an entire property together, each holding a percentage share. Unlike a traditional condo, you do not receive a separate deed to an individual unit. Instead, all co-owners share title to the whole building, and a private TIC agreement between the owners spells out who gets to exclusively occupy which unit (as well as parking spots, storage, etc.) bpfund.com. In simple terms, if you buy a TIC unit, you collectively own the building with your co-owners, but you have the exclusive right to live in your specific unit as outlined in the TIC agreement.

To illustrate the difference: In a condominium, you get a deed to your condo unit (everything inside your unit’s walls is yours in “fee simple” ownership) while common areas are jointly owned by the HOA. In a TIC, there is only one deed for the entire property, held by all co-owners in shares. Everything is collectively owned g3mh.com, but the TIC agreement gives each owner the sole right to occupy their own apartment or unit within the building. This arrangement lets people essentially “buy a unit” in a multi-unit building without legally subdividing the property into separate condos.

TIC agreements are critical documents in this setup. They detail each co-owner’s percentage ownership, their exclusive use areas (unit #1, unit #2, parking space A, etc.), and how the group will handle expenses, repairs, decision-making, and even dispute resolution. The agreement is a private contract (not recorded like a deed) but is legally binding among the owners. It often includes provisions similar to condo bylaws or house rules – for example, pet policies or quiet hours – and outlines what happens if an owner wants to sell their share or if conflicts arise. Prospective TIC buyers should always review the TIC agreement closely (ideally with a real estate attorney) to understand their rights and responsibilities bpfund.com.

TIC vs. Condo vs. Co-op: Key Differences

TICs are often mentioned in the same breath as condos and co-ops, since all three involve multi-unit buildings with multiple stakeholders. However, they differ in ownership structure, financing, and day-to-day governance. Here are the key differences in a nutshell:

-

Ownership Structure: In a condo, each owner holds title to their individual unit (plus an undivided share of common areas), with a recorded parcel map legally delineating each unit. In a TIC, all owners collectively hold title to the entire property in shares, and no unit has its own deed – exclusive unit rights come from the TIC agreement. In a co-op (housing cooperative), an entity (usually a corporation) owns the whole building, and residents don’t own real estate at all – instead, they own shares of the corporation, and their right to a unit comes via a proprietary lease or share certificate.

-

Legal Status and Regulation: Condos are a form of legal subdivision; creating condos requires meeting city subdivision codes and obtaining approval. Co-ops are also recognized in California law as a type of subdivision (stock cooperative), so they too fall under many of the same local regulations as condos andysirkin.com. TICs, by contrast, are not considered a subdivision – they’re treated as a form of co-ownership. This distinction is huge in San Francisco: it means forming a TIC does not require filing maps or getting city approval, unlike condo conversions andysirkin.com. (San Francisco’s strict condo conversion rules therefore do not apply to creating TICs – one reason TICs became a popular workaround, as we’ll see later.)

-

Financing and Mortgages: With a condo, buyers can get a standard mortgage from any conventional lender, and each unit owner has their own loan and pays their own property taxes. Co-ops and TICs traditionally have more limited financing options. Historically, TIC owners had to share one mortgage loan for the whole building, which was cumbersome – if one owner sold, the entire loan often had to be refinanced, and if one owner defaulted, everyone was on the hook. In the last 10–15 years, however, fractional TIC loans have become the norm: certain banks and credit unions (many local to California) offer individual mortgages for each TIC share. With a fractional loan, each TIC owner is responsible only for their own debt – if a neighbor in the TIC misses a payment, it won’t directly affect your loan or credit. These loans are still a niche product (a smaller subset of lenders offer them, and down payments and interest rates tend to be a bit higher than for condos). Co-op financing is also specialized – typically only certain lenders will finance co-op shares, and sometimes the co-op corporation carries a underlying mortgage for the whole building. In short, condos have the widest financing options, TICs and co-ops require specialized loans (expect ~15–20% down and a slightly higher rate in many cases mansionglobal.com).

-

Governance and Resale: Condo owners are part of a Homeowners Association (HOA) with bylaws and elected boards; they can generally sell or rent out their unit freely (with some HOA or city rules) and don’t need other owners’ permission. TIC owners operate via the TIC agreement – there’s no formal HOA, but the owners collectively make decisions (often by vote or consensus as defined in the agreement). Major decisions (e.g. selling the entire building or taking out a new mortgage on it) typically require unanimous or super-majority agreement. Some TIC agreements may give other owners a right of first refusal if one owner sells their share, meaning the remaining co-owners could buy that share or approve the incoming buyer. Co-ops are usually the most restrictive in this regard: the co-op’s board often approves any new buyer or subletter – this can effectively give existing members a say in who joins the community, subject to fair housing laws. As for resale value and liquidity: condos are easiest to sell (largest pool of buyers and lenders). TICs generally sell for less than comparable condos – often around 10–20% lower price for a similar unit, to compensate for the quirks and financing hurdles. Co-ops in SF are fairly rare (and often in luxury older buildings); they also usually trade at a discount to condos due to stricter rules and financing limitations. In down markets, TICs and co-ops can be harder to sell than condos, so buyers and sellers should plan for potentially longer sale timelines.

-

Monthly Costs and Taxes: Condo owners pay their own property tax bills and mortgages, plus monthly HOA dues for common expenses (maintenance, insurance, reserves, etc.). In a TIC, the property tax bill is one single bill for the entire property (since legally it’s one parcel); typically the TIC agreement specifies each owner’s share of property taxes (based on their ownership percentage). TIC owners often contribute monthly to a shared account for property tax, building insurance, and common expenses (similar to paying HOA dues, though it’s not called HOA). If one TIC owner fails to pay their portion of taxes or expenses, the group still has to cover the shortfall – all co-owners are collectively responsible for the property’s liabilities like tax or mortgage liens mansionglobal. In a fractional loan scenario, each TIC owner will pay their own mortgage separately, but things like insurance or any shared utilities will be split. Co-op members usually pay a monthly fee to the co-op that often includes the building’s property taxes, underlying mortgage (if any), insurance, maintenance, sometimes utilities – essentially a “maintenance fee” that covers all communal costs. The co-op corporation then pays taxes and bills.

In summary, TICs occupy a middle ground between condos and co-ops. They provide an ownership stake and occupancy rights similar to a condo, but without the formal legal separation of units. They require trust and cooperation among co-owners like a co-op might, but without some of the heavy governance structure a co-op has. Understanding these differences is crucial before entering a TIC arrangement.

How Did TICs Become Popular in San Francisco? (A Little History)

Tenancy-in-Common arrangements exist in many places, but San Francisco has embraced TICs more than perhaps any other U.S. city – and local conditions are a big reason why. TICs rose to prominence in SF starting in the 1980s-1990s as a creative response to the city’s housing constraints and policies. Here are the key factors that led to the TIC boom:

-

Sky-High Property Prices: San Francisco’s home prices have long been among the highest in the nation. As single-family homes and condos became out-of-reach for many, buyers looked for more affordable ways to own. Buying a TIC share in a multi-unit building came to be seen as a “path to homeownership” for those who couldn’t afford a whole house or condo. Over the past 25+ years, TICs became a major source of relatively affordable entry-level housing in SF g3mh.com.

-

Rent Control and Rental Unit Constraints: SF has strict rent control (for older multi-unit buildings) and strong tenant protections. For landlords, these rules can make owning rental property less enticing (since raising rents or removing tenants is difficult). Some owners of small apartment buildings found they could exit the landlord business by selling their building as TIC units to owner-occupants. Furthermore, a 1994 expansion of rent control (via the state Costa-Hawkins Act’s phased rollout) meant many two- to four-unit buildings in SF ended rent control exemptions; subsequent studies found that landlords responded by taking units off the rental market – often via Ellis Act evictions and then selling as TICs to owner-buyers g3mh.com andysirkin.com. In other words, rent control’s noble aim of protecting tenants had a side effect: it discouraged some landlords from holding onto multi-unit buildings, contributing to more TIC conversions (though it also protected sitting tenants until they left).

-

Condo Conversion Limits: Perhaps the biggest driver of TIC popularity was San Francisco’s extremely restrictive condo conversion laws bpfund.com. Since the 1980s, SF capped the number of apartment buildings that can convert to condos each year (historically via a lottery that allowed only ~200 units/year to convert) andysirkin.com. Large buildings (5+ units) have been outright barred from conversion for decades andysirkin.com. These rules were meant to preserve rental housing and prevent mass evictions. The result was a huge pent-up demand from both owners and buyers for condo ownership that could not be legally met. Enter TICs: forming a TIC doesn’t require City Hall approval (because it’s not a “subdivision”) andysirkin.com, so it became a legal workaround to effectively “split” a building into sellable units without converting to condos. During the 1990s and 2000s, many TIC groups formed with the hope that after a few years of owner-occupancy, they could enter the condo conversion lottery and eventually convert to individual condos (which would significantly boost each unit’s value). In fact, the potential to convert to condo down the road was a major selling point that fueled TIC formations g3mh.com.

-

Local Law and Policy Twists: City policymakers, concerned about losing rental housing, have attempted to rein in TICs over the years – with limited success. In 2001, the SF Board of Supervisors even passed a law to ban the exclusive occupancy agreements that underpin TICs (essentially trying to make the standard TIC arrangement unenforceable). This was quickly challenged in court, and by 2004 the law was struck down as unconstitutional. The courts affirmed that co-owners have the right to contract amongst themselves for occupancy rights. Since TICs aren’t formal subdivisions, the City couldn’t simply outlaw them without running afoul of property rights. Thus, TICs remained legal and grew more common, becoming an established part of the SF real estate landscape by the 2000s.

-

Condo Conversion Crackdown in 2013: By the early 2010s, so many TIC owners were waiting to convert condos that pressure mounted to reform the system. In 2013, San Francisco enacted a major change (often called the “Expedited Conversion Program”). This drastically reduced the number of properties that could convert going forward, effectively freezing out most TICs from ever converting to condos. The city allowed TICs already in the lottery queue to bypass the lottery and convert (with conditions like paying a fee and giving any tenants lifetime leases), but in exchange no new conversion lottery would take new applicants for at least 10 years. This meant any multi-unit TIC created after 2013 would likely never be able to become condos unless the lottery resumed in the far future g3mh.com. Many TIC buildings – some as large as 4, 6, or even 10+ units – essentially became “permanent TICs” with no conversion hope g3mh.com. The expectation was that the lottery might reopen in 2024 (after the 10-year moratorium).

-

2017 and Beyond – Suspension of Conversions: To make matters more complicated, a provision of the 2013 law required lifetime rent-controlled leases for any tenants in a building at the time of condo conversion. Landlord groups sued, and in 2017 the City halted all condo conversion applications for buildings with any tenants, pending resolution of the lawsuit g3mh.com. As of late 2025, this issue still hasn’t been fully resolved – the condo conversion lottery for 3–4 unit buildings remains suspended. Two-unit buildings (owner-occupied by separate owners) have still been able to convert under a bypass process, but 3+ unit TICs have had no path to condo conversion for a decade. The notion of TICs as a temporary bridge to condo ownership has largely faded; today’s buyers mostly assume their TIC will stay a TIC long-term.

In summary, San Francisco’s unique mix of housing pressures and regulations gave rise to the TIC phenomenon. TICs offered a win-win of sorts: buyers got a more affordable way to own in the city’s desirable neighborhoods (often a 20% discount vs condos) bpfund.com, and building owners/landlords could sell units individually for more total profit than selling an entire building in one go andysirkin.com. The City’s stringent condo rules and slow development pipeline essentially forced the market to find another outlet for ownership demand andysirkin.com. While TICs were once seen as a stepping stone to eventual condo conversion, policy changes over the last decade have cemented many TICs as a permanent fixture of San Francisco’s housing market. They’re no longer a fringe idea; TICs are now “a mainstay of San Francisco’s housing market”bpfund.com, albeit one with unique challenges and considerations.

TIC Market Trends and Updates (Late 2025)

How are TICs faring in today’s market? In 2025, TICs continue to represent a small but significant slice of San Francisco real estate. Let’s look at some current trends:

-

Market Share and Pricing: TIC units make up a minority of sales compared to condos, but they do sell. In the first half of 2025, for example, 97 TIC units (in buildings with 3+ units) sold citywide, compared to 813 condo units in similar-sized buildings. The median sale price for those TICs was about $935,000, versus $1,025,000 median for the condos. This corroborates the rule of thumb that TICs tend to be roughly 10–20% cheaper than comparable condos in SF. Lower prices are a key attraction of TICs, especially for first-time buyers. In fact, the “sweet spot” of the TIC market remains the sub-$1 million range – over half of TIC sales fall under $1M, which is considered relatively affordable by SF standards. For context, the city’s median condo price often hovers around $1.2M, and single-family homes even higher, so TICs offer a somewhat less intimidating entry point.

-

Who’s Buying TICs: Buyers are typically those who value more space or prime location over traditional ownership structure. TICs are especially common in classic SF neighborhoods – places like Noe Valley, Eureka Valley (Castro), Mission Dolores, Russian Hill, Nob Hill, Haight-Ashbury, and Alamo Square – where a condo or house might be out of reach, but a TIC unit provides a comparatively affordable way in bpfund.com. Many TIC buyers are owner-occupants (often friends or family team up to buy a building as co-owners), though there are also some investor buyers who purchase TIC shares to rent out. (Note: Renting out a TIC unit may be subject to SF’s rent control if the building is older, and some TIC agreements limit rentals, so investors are a smaller segment.) Overall, TICs remain most popular with owner-occupant buyers who are priced out of condos in their favorite neighborhood.

-

Two-Unit TICs vs. Larger TICs: It’s important to distinguish between TICs in 2-unit buildings and those in 3-or-more-unit buildings. A TIC in a 2-unit building (often a two-flat building) is somewhat closer to a condo in value because SF law does allow a relatively straightforward path to condo conversion for 2-unit TICs (if owner-occupied by separate owners for a period and with a clean eviction history) andysirkin.com. Because of this conversion potential, 2-unit TICs tend to command higher prices (and resale demand) than TICs in larger buildings. In contrast, TICs in 3+ unit buildings, having no conversion path under current rules, are valued purely as long-term TIC ownership. These typically have a deeper discount vs condos and a smaller buyer pool. Buyers of 3+ unit TICs today generally accept that condo conversion is off the table (at least in the foreseeable future).

-

Financing Climate: As of late 2025, interest rates are relatively high (following the overall rise in mortgage rates since 2022). TIC loans are mostly offered as adjustable-rate mortgages (ARMs), with rates around 6–7% for a 30-year loan (with an initial fixed period) at 80% loan-to-value. Fixed-rate TIC loans for 30 years exist but are less common (and come at a premium). The good news is that the roster of lenders offering fractional TIC loans has grown. Several local institutions – e.g. National Cooperative Bank (NCB), Bank of Marin, Bank of San Francisco, Patelco Credit Union, Redwood Credit Union, and others – actively make TIC loans now. This is a big change from 15-20 years ago when only one or two banks would touch TIC financing. Lenders have even rolled out more accommodating programs: for instance, some TIC loans now allow as little as 15% down payments (compared to the 20-30% that was standard before) bpfund.com, and there are programs tailored for self-employed buyers or even for purchasing TICs as rental investments bpfund.com. Greater access to loans has made TIC purchases more attainable than they used to be, though borrowers should still expect a more intensive loan process than a regular mortgage, and possibly slightly higher rates or fees.

-

Legal/Policy Updates: On the legal front, the big question has been: Will San Francisco ever revive the condo conversion lottery for TICs? As noted, the lottery has been on hold since 2013 (with a formal suspension since 2017 for buildings with tenants). There were provisions that the lottery could resume in 2024 at the earliest, and indeed city officials have floated timelines in 2024, 2025 or 2026 for a possible return andysirkin.com. However, as of late 2025, the lottery has not yet been reactivated. It’s a bit of a limbo scenario – any potential restart may come with tougher restrictions (e.g. stricter owner-occupancy requirements, disqualifications for past evictions or buyouts andysirkin.com, etc.), and the city is likely figuring out how to handle the backlog of TIC owners who’ve waited for a decade. Practically speaking, this means buyers should not count on condo conversion unless they’re dealing with a 2-unit building that clearly meets the bypass criteria. For 3-4 unit TICs, treat it as a permanent arrangement (and a bonus if conversion laws ever change in your favor). Aside from conversion issues, there haven’t been major new laws directly harming TIC formation – it remains legal to create TICs (the city hasn’t tried another outright ban). California did pass some broader housing laws (like one in 2022 (SB 9) allowing lot splits and duplex additions), but those don’t directly affect existing TICs except perhaps creating more opportunities for co-ownership in some cases.

Bottom line: the TIC market in 2025 is stable, if somewhat niche. TIC units trade at a relative discount, making them attractive to value-seeking buyers. They are concentrated in desirable neighborhoods where even a discounted unit is appealing. Inventory is limited (since TICs are a fixed pool of older buildings being re-sold), and demand fluctuates with overall market conditions. Lately, higher interest rates and pandemic-era softening in the condo market have tempered TIC sales a bit, but people are still buying TICs as an alternative path to homeownership in San Francisco’s competitive market.

Tips for TIC Buyers and Sellers

Whether you’re thinking of buying a TIC unit or selling one, it’s important to approach these transactions with eyes open. Here are some key tips and considerations for buyers and sellers in the TIC market:

Tips for TIC Buyers

-

Understand What You’re (Not) Getting: When you buy a TIC, you’re buying a share of a building, not a standalone parcel of real estate. You won’t have a condo deed to your unit; instead, you become a co-owner of the whole property with a contract that lets you live in Unit X bpfund.com. Make sure you’re comfortable with the idea of shared ownership and the slightly unconventional nature of TICs. This means accepting a bit more interdependence with your co-owners than condo owners typically have.

-

Review the TIC Agreement Thoroughly: The TIC agreement is essentially your bible for rights and responsibilities. Read it carefully (and have a knowledgeable real estate attorney review it) before you remove contingencies on a purchase bpfund.com. Check how decisions are made (majority vote or unanimous?), how expenses are split, rules on renting your unit, what happens if someone defaults or wants out, any right of first refusal for co-owners, etc. A well-drafted agreement should address things like dispute resolution and sale procedures. If something in the agreement is unclear or concerning, address it before you commit – you might negotiate an amendment or at least know what you’re in for.

-

Secure Specialized Financing Early: Plan your financing upfront with a lender that offers TIC loans bpfund.com. Traditional 30-year fixed mortgages won’t be available from the big banks for TICs. Instead, get pre-approved with a fractional TIC loan program – many local mortgage brokers in SF are familiar with TIC financing. Expect to put down around 20% (although some programs allow 15% down) bpfund.com. Interest rates on TIC loans may be a tad higher than on condos, and they often are adjustable-rate loans. Shop around among the handful of credit unions and banks that do these loans. Getting a rate quote and loan terms in writing will also help you budget the monthly costs accurately.

-

Count the True Costs: Compare the monthly cost of the TIC vs a condo carefully. TIC owners usually split property tax and building insurance, so those will be part of your monthly obligations (often collected as a “TIC HOA” fee). Ask the seller for a breakdown of current monthly expenses per share. Also consider future repairs – is there a reserve fund or will you likely face special assessments? Much like a condo, you want to avoid buying into a building with major deferred maintenance unless the price reflects it. Also note that property tax reassessment will occur for your share upon sale – in SF, each TIC share is typically assessed based on its sale price (though technically the whole building is assessed and then apportioned), so you’ll pay property taxes roughly equivalent to 1.2% of your purchase price annually (split into your monthly budget).

-

Assess Conversion Potential (but Don’t Count on It): If you’re buying a TIC in a 2-unit building, research whether it meets the condo conversion bypass criteria (both units owner-occupied by separate people for a year, no evictions, etc.) andysirkin.com. If so, there’s a decent chance you and your co-owner can eventually convert to condos – which is a great upside. However, if it doesn’t meet the criteria (e.g. one unit is tenant-occupied or an owner owns both units initially), conversion might not be possible. For 3- or 4-unit TICs, as discussed, conversion is currently off the table pending lottery reinstatement. It’s safest to buy a TIC for what it is now, not what it might become. Any conversion possibility should be treated as a bonus, not an assumption. That said, knowing the building’s status can inform your decision – for example, a 4-unit TIC that participated in the old lottery might have a latent chance if the lottery returns. Consult with a TIC-savvy realtor or attorney about the latest local rules if conversion is a major consideration for you.

-

Plan for the Long Term & Resale: Be prepared to hold the TIC for a longer period or through market ups and downs. TICs can be harder to sell in a slow market, since they have a narrower pool of buyers. If there’s a downturn, you may need to price aggressively to sell. Thus, it’s wise not to overstretch financially when buying a TIC – keep a cushion. When the time comes to resell, you’ll want the unit to appeal to the next crop of TIC buyers (typically budget-conscious buyers who value the location). That means maintaining the property well and perhaps being flexible on price. In short, think of a TIC as a long-term home; if you wouldn’t be comfortable holding it for many years, you need an exit strategy.

-

Work with Experienced Professionals: Use a real estate agent who knows TICs and a mortgage broker or lender who has done TIC loans. The escrow process for TICs can be a bit different (for example, TIC sales often involve all co-owners signing certain documents like a new TIC agreement or deed). An experienced TIC agent will ensure all the paperwork (title, TIC agreement, etc.) is in order and can often connect you with reputable TIC lenders and attorneys. Don’t be shy about asking professionals about their TIC experience.

-

Community and Co-owner Considerations: Finally, remember that when you buy into a TIC, you are also effectively entering a small community – your co-owners are somewhat like partners. You don’t have to be best friends, but you will be making joint decisions about the property. Try to meet the other owners (if it’s an existing TIC) or size up your fellow buyers (if you’re forming a new TIC with others). Make sure there’s a basic level of trust and good communication. A lot of TIC success comes down to reasonable, responsible co-owners and clear agreements. If something feels off (say, one owner is notably uncooperative or finances seem unbalanced), take pause and address it if you can. It’s easier to enter a TIC with the right expectations than to fix issues later.

Tips for TIC Sellers

-

Understand the Buyer Pool and Price Accordingly: When selling a TIC unit, recognize that your buyer pool is smaller than for a condo or single-family home. Not everyone is open to the idea of a TIC, and not every buyer can get the specialized financing. That said, San Francisco has a fairly established TIC market, and dozens of TIC units sell each quarter – so there is a market. The key is to price the property realistically, reflecting the TIC discount. Look at recent TIC sales (not just condos) in your area to gauge value. Overpricing a TIC can lead to it sitting on the market longer, especially if interest rates are high or if buyers have plentiful condo options. Many TIC sellers price roughly 10-20% below an equivalent condo’s price, to account for the differences.

-

Market the Advantages: When listing, highlight the benefits that your TIC offers. Emphasize the home’s features (size, location, upgrades) that a buyer might not afford in a condo at the same price. For instance: “This TIC offers a spacious three-bedroom flat in Pacific Heights for under $X, a rare find compared to condos in the neighborhood.” If the TIC has a unique selling point – e.g. it’s in a 2-unit building eligible for fast-track condo conversion, or it comes with 2-car parking, or has super low property taxes due to a historical assessment – make sure buyers know. Education is part of the marketing: your listing agent should be prepared to explain what a TIC is and why it’s a great opportunity. Many buyers in SF are now aware of TICs, but providing a one-sheet FAQ at open houses (covering financing options, etc.) can be helpful.

-

Have Financing Resources Ready: One way to ease buyer concerns is to do some homework on financing. Consider getting your property “pre-approved” or at least evaluated by a TIC lender. For example, some sellers will have a TIC lender ready to speak with interested buyers, or even have a rate quote available (“Fractional financing available from Lender X with 20% down; loan officer contact info: ___”). This signals to buyers (and their agents) that financing is feasible and lined up. Also, if your current loan is a group loan (older TIC setup), look into the process for splitting into fractional loans – sometimes marketing the unit as “eligible for fractional refinancing” can reassure buyers. In 2025, most TICs on the market already have fractional loans in place, but if not, be proactive in addressing that.

-

TIC Agreement and Disclosures: Make sure your TIC agreement is up-to-date and well-drafted. If you’ve been in a TIC for a long time, review it to see if any amendments occurred or if anything might raise red flags to buyers. It’s wise to provide the TIC agreement and financial statements (property tax splits, recent common expenses, etc.) to serious buyers early (usually as part of a disclosure package). Transparency builds trust. Additionally, disclose any quirks in the co-ownership arrangement: do you have any outstanding disputes with co-owners? Any big repairs planned? Remember, a buyer is not just buying your unit – they’re buying into the group. So if, say, the TIC collectively decided to remodel the roof next year and each owner must contribute $10k, disclose that. It’s similar to how condo sellers disclose pending HOA special assessments.

-

Cooperate with Your Co-owners: Selling a TIC unit often requires a bit of cooperation from the other co-owners. For instance, all TIC owners typically sign a new deed (granting title to the new buyer and re-establishing the TIC shares) at closing. Your neighbors will also be dealing with a new partner once you sell. Good etiquette (and sometimes TIC agreement rules) suggest giving your co-owners a heads-up that you’re selling and sharing information about the buyer when the time comes. In some TICs, co-owners might even have a right of first refusal to buy your share – ensure you honor any such provision by formally offering it to them if required. Even if not required, keeping communication open can smooth the process (e.g., coordinating showing times if the building has common areas or ensuring the buyer’s inspectors can access common systems like the furnace, etc.). A friendly, cooperative sale will also make the transition easier for the incoming buyer and the remaining owners.

-

Staging and Improvements: Treat the sale similarly to a condo in terms of presentation – stage the unit nicely, complete any minor repairs that could be objections, and perhaps spruce up common areas if they’re overly cluttered or rundown. While you don’t control the whole building, you and your co-owners collectively benefit from giving a good impression (just as an HOA might spruce up a lobby before selling units). If you’re the only one selling at the time, even small touches like a fresh coat of paint in the entryway or making sure the landscaping is neat can help. If your TIC is in an older building, consider providing any inspection reports upfront (e.g., a roof report or pest report), so buyers know what they’re getting. This can preempt fears about “what if the building needs X, Y, Z.”

-

Leverage Experienced Agents/Attorneys: Use a real estate agent experienced in TIC transactions to list your unit. They will know how to address buyer questions, work with the title company on the unusual aspects of TIC escrow, and market the property correctly (including emphasizing that TIC loans are available). Likewise, have a real estate attorney on call in case any TIC-specific legal questions arise during the sale. Many TIC sales go smoothly, but if a buyer or their lender requests an amendment to the TIC agreement or a clarification, you’ll want professional guidance.

Selling a TIC in San Francisco is very doable – thousands have sold over the years – but it requires the right preparation and mindset. By pricing it right, being transparent, and marketing the unique value proposition, you can find the right buyer who appreciates the home (and isn’t scared off by the TIC aspect). Remember, many buyers actively seek TICs because of the price advantage and location benefits, so your goal is to reach those people and give them confidence to proceed.

Conclusion

Tenancy-in-Common units are an integral part of San Francisco’s real estate tapestry. They offer a creative solution to the city’s limited housing options – allowing people to buy into neighborhoods they love at a relatively lower cost, albeit with some extra complexity. We’ve seen how TICs evolved out of SF’s policy environment and how they continue to adapt. Owning or buying a TIC isn’t for everyone, but for many San Franciscans it’s been a smart strategy to achieve homeownership in an otherwise prohibitive market bpfund.com. The key is to be well-informed: understand the legal and financial nuances, work with professionals who know TICs, and go in with a cooperative spirit. If you do, a TIC can be not just a “tenancy in common” but also a rewarding experience in community-oriented home ownership.

Whether you’re a buyer considering a TIC as your path to owning a piece of San Francisco, or a homeowner thinking of selling a TIC share, we hope this guide has shed light on the major points to know. San Francisco’s TIC market may be uncommon, but it’s certainly not unknowable – with the right knowledge and resources (and perhaps a pinch of patience), you can navigate it successfully. Good luck, and happy house hunting or selling!

Sources:

-

Goldstein, Gellman et al., “Tenancy in Common in San Francisco – FAQs,” (2017)g3mh.comg3mh.com.

-

Vivre Real Estate, “Tenancy in Common in San Francisco: Ultimate TIC Guide,” (Apr 6, 2023)vivrerealestate.comvivrerealestate.com.

-

Sirkin Law (Andy Sirkin), “Tenancy in Common – An Introduction,”andysirkin.comandysirkin.com and TIC resources.

-

Dpaul Brown, Realtor, “Condo vs. TIC vs. Co-op,” (Mar 10, 2021)dpaulsf.comdpaulsf.com.

-

Inside SF Real Estate (E. Bermingham), “State of the TIC Market – 2024 & 2025,”insidesfre.cominsidesfre.com.

-

Bridgepoint Funding (M. Trejo), “Why TICs Are So Popular in San Francisco: A Buyer’s Guide,” (Sept 11, 2025)bpfund.combpfund.com.

-

Mansion Global Library, “What is tenancy in common?” (Updated June 26, 2024)mansionglobal.commansionglobal.com

Parkside, San Francisco – July 2025 Market Update & Tips

Parkside is a charming neighborhood in the southwest part of San Francisco, known for its quiet residential streets and classic single-family homes. Located just inland from Ocean Beach and north of Stern Grove, Parkside offers a unique blend of city and suburb – you get an urban vibe with plenty of local eateries and parks, yet a laid-back atmosphere on wide, peaceful avenues. In this post, we’ll dive into the latest July 2025 market stats for single-family homes in Parkside, provide actionable tips for buyers and sellers, and explore the local lifestyle, amenities, and accessibility that make this neighborhood special.

Parkside Single-Family Market Snapshot (July 2025)

The single-family home market in Parkside is very competitive as of July 2025. The median sale price for a house here is around $1.65 million, with recent sales ranging from approximately $800,000 on the low end to about $3.5 million for larger or updated homes. On average, Parkside homes sell for roughly $999 per square foot and they spend only ~17 days on the market before going under contract. Notably, properties have been selling for about 116% of their list price, on average. In other words, the typical home is selling 16% above the asking price, a clear indicator of strong demand and competitive bidding.

Such quick sales and above-asking offers point to a market that favors sellers. Inventory is quite limited – as of late July, only 3 single-family homes were actively listed for sale in Parkside. This low supply, coupled with high buyer demand, has created conditions where multiple offers are common. For buyers, it means being prepared to move fast and potentially bid over the list price. For sellers, it means well-priced homes in good condition are likely to attract a lot of attention and possibly sell above asking. Below, we’ll offer some specific tips for navigating this market as a buyer or seller.

Tips for Parkside Home Buyers

In a hot market like Parkside’s, home buyers should be proactive and strategic. Here are some actionable tips if you’re looking to buy a single-family home in Parkside:

-

Get Pre-Approved & Budget for Over-Asking Offers: Secure a mortgage pre-approval before you start home shopping, so you can act quickly. Given that homes are selling around 16% above list price on average, be ready for the possibility of bidding over the asking price. Build some cushion into your budget and work with your agent to understand recent comps (comparable sales) so you know what a realistic winning offer might look like.

-

Be Ready to Act Fast: With homes averaging just 17 days on the market, there’s not much time to hesitate. If a Parkside home meets your criteria, try to see it as soon as possible and be prepared to write an offer quickly. This might mean having your real estate agent on speed dial and staying flexible for last-minute showings.

-

Make a Strong, Clean Offer: In multiple-offer situations, the terms of your offer matter as much as the price. Consider offering a larger earnest money deposit, a short contingency period (or even waiving non-essential contingencies if you’re comfortable), and a closing timeline that suits the seller’s needs. A “clean” offer with fewer hurdles can stand out, especially when many bids come in.

-

Research the Neighborhood and Amenities: Show the seller you’re serious about their home. It helps to know and mention what you love about the property and Parkside itself. Sellers often appreciate buyers who value the home’s location (for example, its proximity to Ocean Beach or good transit access). While writing a personal buyer letter is less common these days, you can still have your agent convey your enthusiasm and local knowledge. Being informed about Parkside’s lifestyle (parks, schools, community vibe) can indirectly strengthen your position by demonstrating you’re committed to the area.

-

Stay Patient and Persistent: Lastly, be prepared that you may need to make a few offers before one is accepted – that’s normal in a competitive market. Try not to get discouraged. New listings pop up in Parkside periodically, and demand can fluctuate. By staying ready and persistent, you’ll improve your chances of landing the right home when the opportunity comes.

Tips for Parkside Home Sellers

If you’re looking to sell your single-family home in Parkside, you’re in a strong position in 2025 – but a good strategy can help you maximize your sale price and ensure a smooth process. Here are tips for sellers in the current market:

-

Price Strategically: Even though many homes are selling above asking, it’s important to set a smart listing price. An attractive price will generate buzz and could lead to competitive bids that drive the price up. Overpricing, on the other hand, may cause your home to sit on the market longer than the average (which is currently only ~17 days in Parkside). Work with a knowledgeable agent to review recent neighborhood sales and choose a listing price that reflects market value and invites strong offers.

-

Prepare Your Home to Shine: Buyer demand is high, but well-presented homes will still fetch the best results. Before listing, take time to declutter, clean, and stage your home. Consider small upgrades or fixes (fresh paint, landscaping touch-ups, fixing that leaky faucet) that can make a big difference in photos and showings. High-quality marketing – professional photos, maybe even 3D tours or videos – will attract more buyers. In Parkside’s market, a little preparation can translate into buyers feeling more confident about your property and possibly bidding higher.

-

Plan for a Quick Sale: With the pace of this market, be ready for a swift transaction. It’s common to set an offer deadline shortly after the first open house (for example, the following week) to encourage multiple bids. Once you accept an offer, escrows can close in as little as 21-30 days if the buyer is prepared. Start planning your next move early (whether it’s lining up your next housing or arranging movers) so you’re not caught off-guard by a fast timeline.

-

Review Offers Carefully (Not Just the Price): When the offers come in, look beyond just the top-line price. Examine the terms and contingencies: Is the highest offer contingent on the buyer selling their current home? Is one offer all-cash or with a larger down payment (which might mean fewer financing hurdles)? How flexible is the closing date? Sometimes a slightly lower offer with better terms or a very secure financing situation can be a smarter pick. Your agent can help you compare the merits of each offer.

-

Leverage the Demand – But Stay Realistic: Parkside’s seller’s market means you have the advantage, but it’s still important to stay realistic and cooperative during negotiations. Buyers paying a premium will expect the home to be in the condition presented, for example. Being transparent on property disclosures, accommodating reasonable inspection requests, or offering a small repair credit (if issues arise) can keep the deal on track. Remember, the goal is not just a high price, but a successful closing. By working amiably with a serious buyer, you’ll increase the chances of a smooth escrow and a completed sale at top dollar.

Parkside Lifestyle and Amenities

Parkside’s proximity to Ocean Beach means residents can enjoy stunning Pacific sunsets and seaside recreation just minutes from home. Beyond the beach, the neighborhood is surrounded by green spaces and local attractions. To the south, Stern Grove is a beloved park where tall eucalyptus and pine trees shelter walking paths and picnic areas. Every summer, Stern Grove hosts a free outdoor music festival with concerts on Sundays, adding a cultural highlight to the local lifestyle. Just east of Parkside lies McCoppin Square, basically the “village green” of the district – it’s a large community park that even houses the Parkside branch library, making it a popular gathering spot for families and neighbors. Small playgrounds and mini-parks are scattered throughout the area as well, giving Parkside a refreshing abundance of outdoor spaces.

Parkside might feel tranquil, but you won’t lack for things to do. Ocean Beach is practically your backyard – residents often take morning jogs or evening strolls along the sandy shore, and surfers can be spotted catching waves year-round (wetsuit recommended, as the water is chilly!). The San Francisco Zoo is also nearby at the southwest corner, offering a fun outing within minutes of home. When it comes to dining and shops, Taraval Street is Parkside’s main corridor. Along Taraval and the surrounding blocks, you’ll find a variety of local restaurants, cafes, and services. In fact, one longtime resident highlighted that Parkside has “great authentic restaurants, from Chinese food to Irish grub” and appreciated how it’s “close to the beach, the SF zoo, and the Great Highway,” while still having “easy access to different parts of the city.”trulia.com Many of the eateries reflect the diverse community – you can grab dim sum or noodles at a family-run Chinese spot, enjoy a hearty brunch at a local diner, or even find a cozy pub for a pint. For more shopping and entertainment, the Stonestown Galleria mall and Lake Merced (for golf and boating) are just a short drive away, showing how Parkside sits in a convenient pocket of the city.

Transportation and Accessibility

Living in Parkside offers a balance between peaceful living and connectivity. The neighborhood is served by the Muni Metro L-Taraval line, a light-rail streetcar that runs along Taraval Street and links Parkside to downtown San Francisco. Hop on the L line, and you can reach the West Portal transit hub in a few minutes or ride all the way downtown (roughly a 30–40 minute journey to the Embarcadero, under normal conditions). One resident noted it’s “super easy – two blocks to [the Muni] train, then downtown … 35 min on a good day”trulia.com. Several Muni bus lines also weave through or near Parkside. For example, the 28-19th Avenue bus provides north-south service along 19th Ave (connecting to Golden Gate Bridge transit and to Daly City BART), and other buses link to nearby neighborhoods and BART stations for commuters.

For drivers, 19th Avenue (Highway 1) forms Parkside’s eastern boundary and is a major artery that makes it straightforward to travel north toward Golden Gate Park and the Richmond District or south toward Interstate 280 (which leads down the Peninsula). During peak hours, 19th Ave can be busy, but it remains a direct route for crosstown access. The Great Highway along Ocean Beach, on the west side, offers a scenic drive and an alternate north-south route when open. Overall, while Parkside is farther out from the downtown core, residents have multiple transit options and road connections that keep the neighborhood well-integrated with the rest of San Francisco. It’s easy enough to get around, whether you’re commuting to work or just exploring other parts of the city.

Schools and Education

Parkside is home to a number of educational institutions that residents may find appealing. The neighborhood includes several public schools (serving elementary and high school students) and is also near a variety of private school options. In fact, one resident noted that “it’s close to schools” and that there are many playgrounds and green spaces aroundtrulia.com – a plus for families with children. Without diving into specific school ratings (which can change and are subject to personal interpretation), it’s fair to say Parkside families have access to nearby schools for all ages, from preschools and K-5 campuses up through high school. Notably, Abraham Lincoln High School sits just at the edge of the neighborhood, and other well-known San Francisco schools are a short drive away. For higher education, San Francisco State University (SFSU) is only a few minutes south (near 19th Ave and Lake Merced), and being close to a major university adds to the area’s appeal – whether for attending classes, cultural events, or simply the youthful energy it brings to the vicinity.

(Fair Housing Note: We describe schools only in factual terms here. Parkside’s appeal to households can include the convenience of local schools, but we make no qualitative claims about the schools themselves.)

Conclusion

Parkside’s single-family home market in July 2025 is characterized by low inventory and high demand – a dynamic that creates opportunities for sellers and challenges for buyers. By understanding the market stats (like the ~$1.65M median price and 16% above-list sale trend) and following the tips above, buyers can improve their odds of success and sellers can maximize their results. Beyond the numbers, it’s easy to see why Parkside is in demand: the neighborhood offers a comfortable, family-friendly lifestyle with beach sunsets, big parks, and local charm, all within San Francisco’s city limits. For home seekers, Parkside provides a chance to enjoy a more relaxed slice of the city without sacrificing access to amenities or transit. And for homeowners, the strong community feel and ever-present buyer interest mean your investment is poised to remain attractive.

Whether you’re considering buying or selling in Parkside, we hope this overview has been practical and informative. With the right preparation and perspective, you can make the most of Parkside’s vibrant market and wonderful neighborhood lifestyle. Good luck, and enjoy all that Parkside has to offer – from the ocean air to the concerts in the grove!

Sources: Parkside market data from July 2025 residential report; community insights from resident reviews and local information trulia.com mapquest.com trulia.com trulia.com.

Prepare for Tax Season – Home-Related Tax Deductions

Homeowner Tax Tips

Tax season. Just the words can either scare you or put you to sleep. But if you’re a homeowner, there’s a silver lining: potential savings!

You’ve probably heard that you can deduct the interest you pay on your mortgage — but did you know there are many other ways homeowners can reduce their tax burden?

Before you start your return, read this post for common home-related tax deductions, eligibility requirements, and tips on how to maximize your savings.

Home-Related Tax Savings: The Basics

Before we get into the details, it’s important to define some important terms to set the stage.

Tax Deductions vs. Tax Credits

Most tax savings opportunities for homeowners come in the form of tax deductions. Deductions work by reducing your taxable income — essentially, the government allows you to subtract certain expenses from your total income before calculating how much you owe in taxes. This means a lower taxable income and, ultimately, a lower tax bill. For example, if you earn $50,000 and claim tax deductions worth $5,000, you will only pay taxes on $45,000.

Tax credits, on the other hand, directly reduce your tax bill, rather than your taxable income. That means that if you owe $10,000 in taxes and claim a tax credit worth $2,000, your tax bill will be reduced to $8,000.

Pro Tip: Meticulous record-keeping is crucial. Keep detailed records of all potentially eligible expenses. This will make tax time much smoother and ensure you don’t miss out on any deductions.

Itemized Deductions vs. Standard Deduction

To understand what deductions apply to your situation, it’s important to know the difference between itemized deductions and the standard deduction. The standard deduction is a fixed dollar amount that you can subtract from your adjusted gross income (AGI) regardless of your actual expenses. Itemized deductions, on the other hand, are specific expenses that you can deduct, such as mortgage interest, property taxes, and charitable contributions.

You’ll need to choose whether to itemize or take the standard deduction. Generally, you should itemize if your total itemized deductions exceed the standard deduction. Most home-related deductions are only applicable if you choose to itemize.

2025 Standard Deduction Amounts

- Single and Married Filing Separately: $15,000

- Head of Household: $22,500

- Married Filing Jointly: $30,0001

Source: IRS

Key Home-Related Tax Deductions and Credits

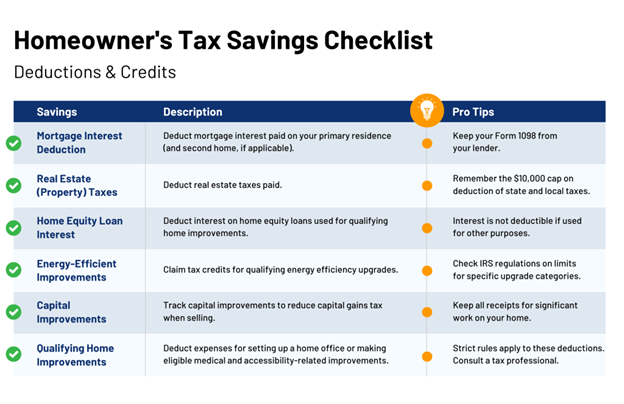

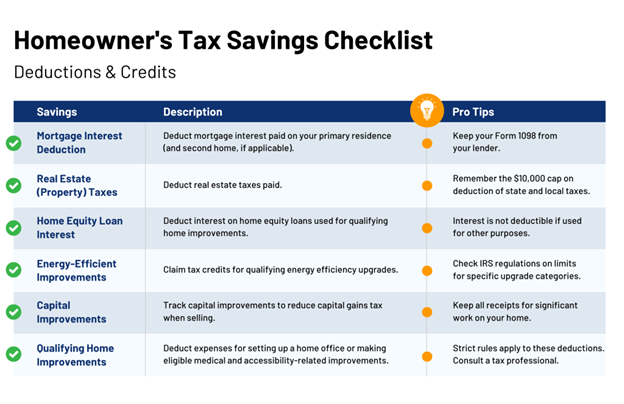

If you do choose to itemize your taxes, common tax deductions and credits available to homeowners include:

Mortgage Interest Deduction